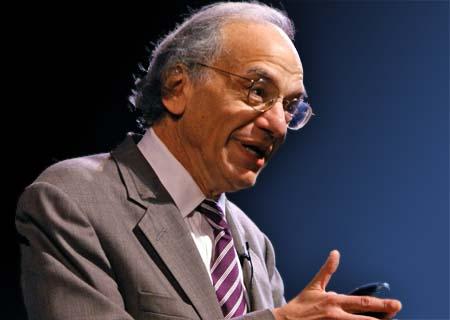

(3) Derives 50 percent or more of its annual revenues from selling or sharing consumers’ personal information.Īpplicable to Employees and Business Contacts? (2) Alone or in combination, annually buys, sells, or shares the personal information of 100,000 or more consumers or households or (1) As of January 1 of the calendar year, had annual gross revenues in excess of $25,000,000 in the preceding calendar year or 11, §§ 7000-7304 (2023)įor-profit entity that collects California consumers’ personal information, or on the behalf of whom such information is collected and that alone, or jointly with others, determines the purposes and means of the processing of consumers’ personal information, that does business in the State of California, and that: The A.I.-fueled boom is “not a bubble yet,” he said.Click below to download a full summary of the law.Ĭalifornia Consumer Privacy Act of 2018 as amended by California Privacy Rights Act of 2020 (CCPA As Amended)ĬAL. While admitting that A.I.-related stocks may be “slightly overvalued” in the long term, Siegel noted that in the short term “momentum can carry stocks far higher than their fundamental value, and no one can predict how high they might go.”

companies: Apple, Microsoft, Alphabet, and Amazon. stocks added $300 billion in value on Thursday, according to Reuters, as investors plunged into companies working on the new technology.īy market close Friday, Nvidia’s market cap had risen to over $960 billion, bringing it close to the $1 trillion threshold now held by just four U.S. The jump in share prices increased Nvidia’s market capitalization by $184 billion. Shares in Nvidia surged by over 24% on Thursday after the chipmaker surprised analysts by forecasting $11 billion in sales for the current quarter, much higher than expected. “There was excitement about A.I., and Nvidia ratified that excitement with blowout earnings,” Siegel said on CNBC on Monday.

0 kommentar(er)

0 kommentar(er)